Forecasting The Future: 6 Analyst Projections For MP Materials

Author: Benzinga Insights | November 10, 2025 06:45am

Ratings for MP Materials (NYSE:MP) were provided by 6 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

1 |

1 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

2 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

1 |

0 |

0 |

| 3M Ago |

1 |

0 |

0 |

0 |

0 |

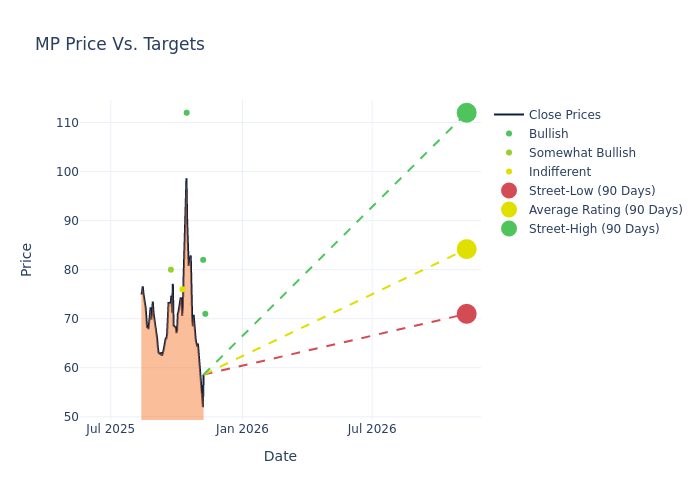

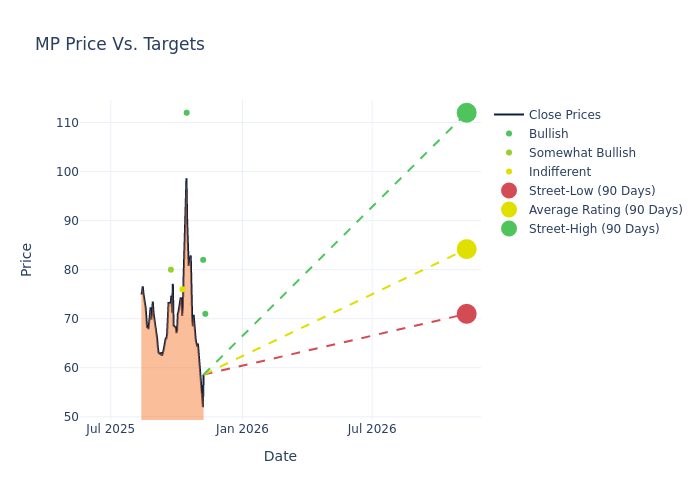

Insights from analysts' 12-month price targets are revealed, presenting an average target of $83.83, a high estimate of $112.00, and a low estimate of $71.00. Marking an increase of 28.97%, the current average surpasses the previous average price target of $65.00.

Diving into Analyst Ratings: An In-Depth Exploration

A clear picture of MP Materials's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Corinne Blanchard |

Deutsche Bank |

Raises |

Buy |

$71.00 |

$68.00 |

| Matt Summerville |

DA Davidson |

Maintains |

Buy |

$82.00 |

$82.00 |

| Lawson Winder |

B of A Securities |

Raises |

Buy |

$112.00 |

$78.00 |

| Raj Ray |

BMO Capital |

Announces |

Market Perform |

$76.00 |

- |

| Dennis Ip |

Daiwa Capital |

Announces |

Outperform |

$80.00 |

- |

| Matt Summerville |

DA Davidson |

Raises |

Buy |

$82.00 |

$32.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to MP Materials. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of MP Materials compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of MP Materials's stock. This examination reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of MP Materials's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on MP Materials analyst ratings.

Discovering MP Materials: A Closer Look

MP Materials Corp is the producer of rare earth materials in the Western Hemisphere. The company owns and operates the Mountain Pass Rare Earth Mine and Processing Facility, the only rare earth mining and processing site of scale in North America. The company is also developing a rare earth metal, alloy, and magnet manufacturing facility in Fort Worth, Texas. The company's operations are organized into two reportable segments: Materials and Magnetics.

Financial Milestones: MP Materials's Journey

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Decline in Revenue: Over the 3M period, MP Materials faced challenges, resulting in a decline of approximately -6.69% in revenue growth as of 30 September, 2025. This signifies a reduction in the company's top-line earnings. When compared to others in the Materials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -78.02%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): MP Materials's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -2.81%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): MP Materials's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -1.36%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.51, MP Materials adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: MP