A Closer Look at BlackRock's Options Market Dynamics

Author: Benzinga Insights | November 10, 2025 01:03pm

Whales with a lot of money to spend have taken a noticeably bearish stance on BlackRock.

Looking at options history for BlackRock (NYSE:BLK) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $292,672 and 3, calls, for a total amount of $111,400.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $700.0 to $1100.0 for BlackRock during the past quarter.

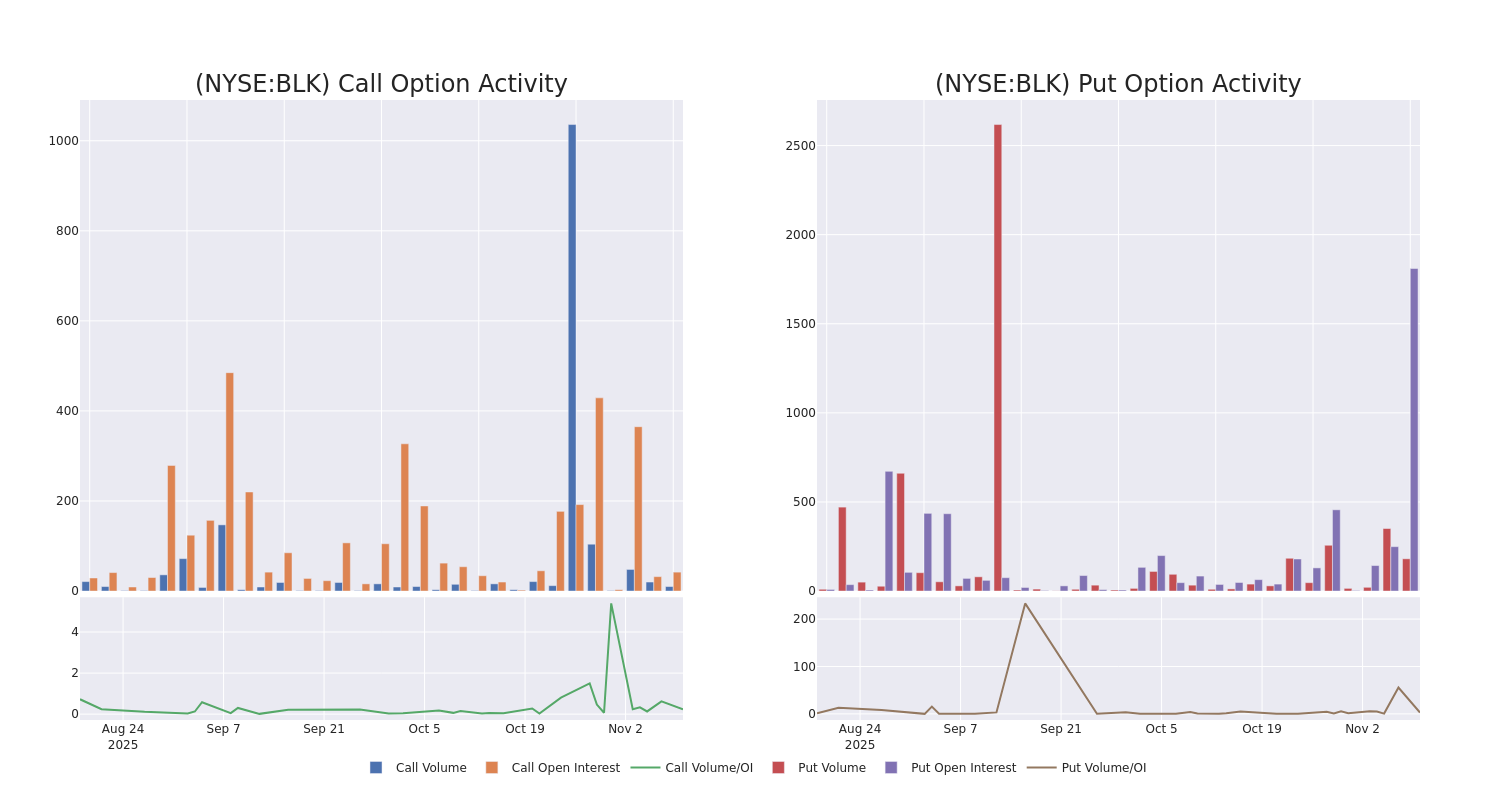

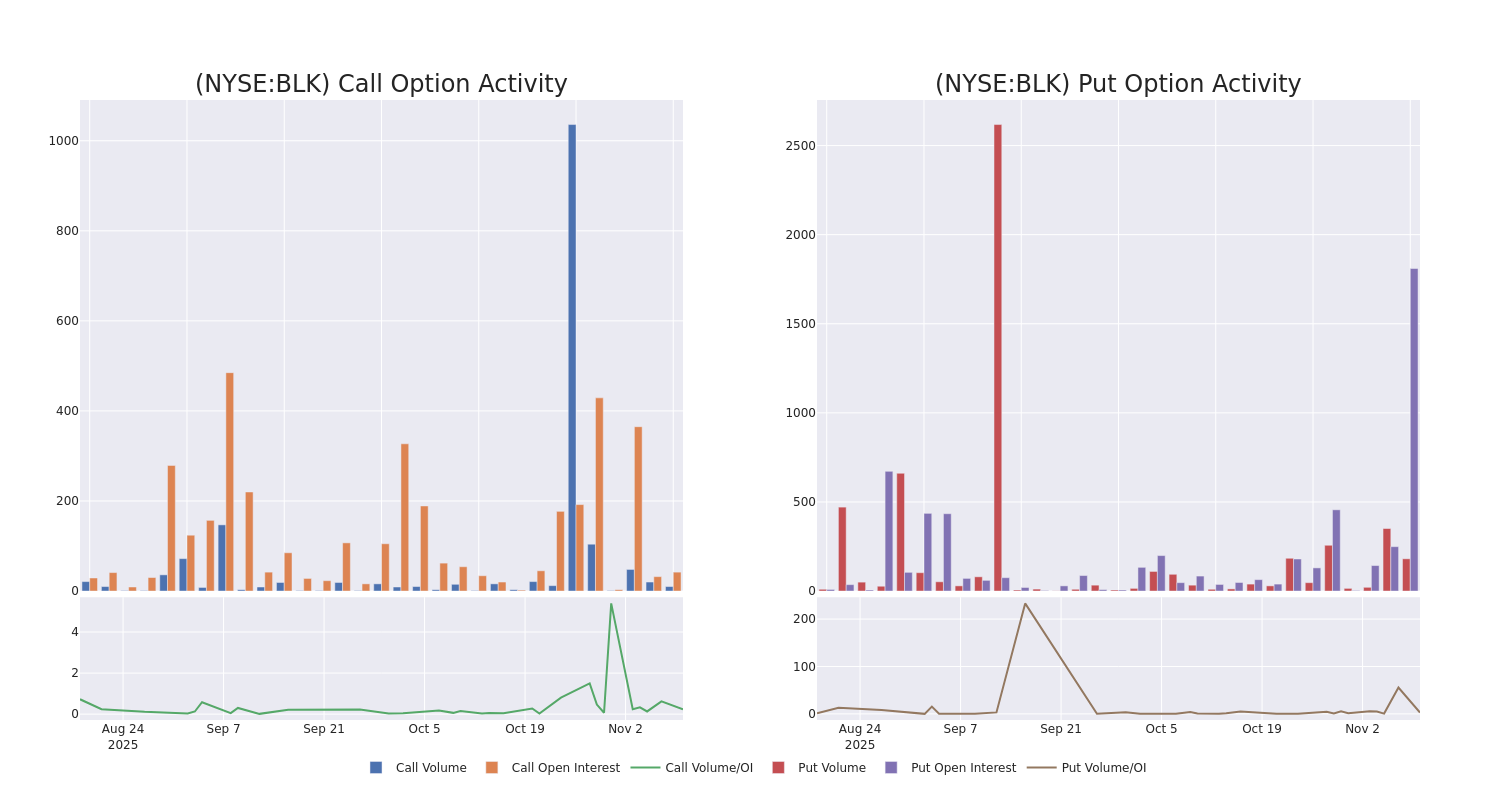

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for BlackRock's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of BlackRock's whale trades within a strike price range from $700.0 to $1100.0 in the last 30 days.

BlackRock Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| BLK |

PUT |

SWEEP |

BULLISH |

11/21/25 |

$12.2 |

$12.0 |

$12.1 |

$1060.00 |

$142.7K |

50 |

119 |

| BLK |

PUT |

SWEEP |

BEARISH |

11/21/25 |

$19.6 |

$17.3 |

$19.6 |

$1090.00 |

$50.9K |

187 |

26 |

| BLK |

CALL |

TRADE |

BULLISH |

04/17/26 |

$399.2 |

$389.8 |

$396.0 |

$700.00 |

$39.6K |

2 |

0 |

| BLK |

PUT |

SWEEP |

NEUTRAL |

11/14/25 |

$24.9 |

$21.1 |

$22.75 |

$1090.00 |

$38.5K |

80 |

13 |

| BLK |

CALL |

SWEEP |

BEARISH |

12/19/25 |

$46.4 |

$45.0 |

$45.0 |

$1060.00 |

$36.0K |

36 |

8 |

About BlackRock

BlackRock is the largest asset manager in the world, with $13.464 trillion in assets under management at the end of September 2025. Its product mix is diverse, with 55% of managed assets in equity strategies, 24% in fixed income, 9% in multi-asset classes, 7% in money market funds, and 5% in alternatives. Passive strategies account for more than two-thirds of long-term AUM, with the company's ETF platform maintaining a leading market share domestically and on a global basis. Product distribution is weighted more toward institutional clients, which, by our calculations, account for around 80% of AUM. BlackRock is geographically diverse, with clients in more than 100 countries and more than one-third of managed assets coming from investors domiciled outside the US and Canada.

Following our analysis of the options activities associated with BlackRock, we pivot to a closer look at the company's own performance.

Where Is BlackRock Standing Right Now?

- Trading volume stands at 160,504, with BLK's price down by -0.05%, positioned at $1081.62.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 65 days.

What The Experts Say On BlackRock

In the last month, 5 experts released ratings on this stock with an average target price of $1401.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from B of A Securities persists with their Buy rating on BlackRock, maintaining a target price of $1456.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for BlackRock, targeting a price of $1486.

* An analyst from Keefe, Bruyette & Woods persists with their Outperform rating on BlackRock, maintaining a target price of $1300.

* Maintaining their stance, an analyst from TD Cowen continues to hold a Buy rating for BlackRock, targeting a price of $1407.

* An analyst from Barclays persists with their Overweight rating on BlackRock, maintaining a target price of $1360.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for BlackRock, Benzinga Pro gives you real-time options trades alerts.

Posted In: BLK