| # | Filing Date | Period End Date | Type | Report Link |

|---|---|---|---|---|

| No Data found | ||||

| # | Date | Analyst Firm | Upside/Downside | Price Target Change | Rating Change | Current Rating |

|---|

https://www.federalreserve.gov/monetarypolicy/files/20240705_mprfullreport.pdf

https://www.federalreserve.gov/monetarypolicy/files/20240705_mprfullreport.pdf

https://www.federalreserve.gov/monetarypolicy/files/20240705_mprfullreport.pdf

Good Morning Traders! In today's Market Clubhouse Morning Memo, we will discuss SPY, QQQ, AAPL, MSFT, NVDA, GOOGL, META, an...

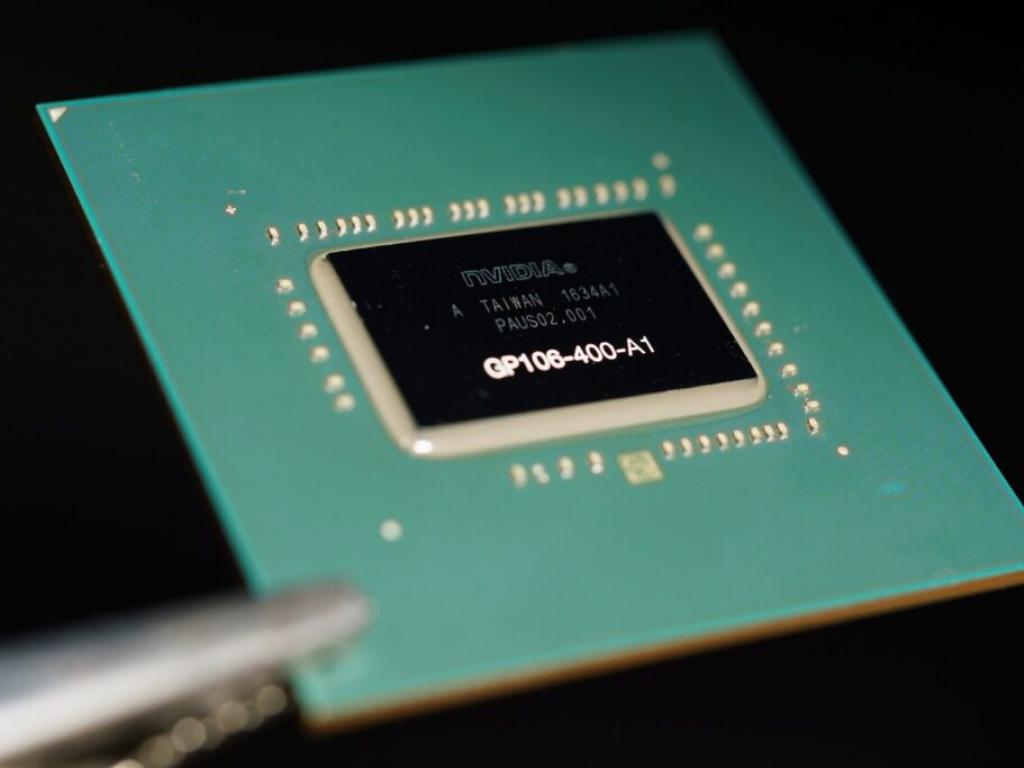

Nvidia (NVDA) expected to sell $12B of AI chips in China this year, surpassing Huawei's $10.3B revenue; Despite export cont...

June jobs report shows strong employment growth but slower wage increases, supporting expectations for upcoming interest rate c...